A durable power of attorney is a legal paper that lets you pick a trusted person to handle your money and legal choices if you can’t. The word “durable” is the important part—it means the paper keeps working even if you get sick or have an accident that makes it so you can’t make decisions for yourself.

Your Financial Safety Net Explained

Think of it like having a “backup pilot” for your life. While you’re healthy and flying your own plane, they are just a passenger. But if you suddenly can’t fly the plane—maybe because of an accident or sickness—your backup pilot can take over right away. They will follow the flight plan you already made. That’s exactly what a durable power of attorney (DPOA) does.

This paper is a very important part of planning for the future in Arkansas. You are the principal. You pick someone you trust completely to be your agent (sometimes called an attorney-in-fact). This person gets the power to do important things for you, like:

- Paying your monthly bills and house payment

- Taking care of your bank accounts and investments

- Filing your taxes

- Handling the buying or selling of your house or land

To get started, it helps in understanding what a Power of Attorney entails. A durable power of attorney adds an extra layer of safety for whatever might happen in the future.

Why Durability Matters So Much

The best thing about a DPOA is that it lasts. A regular power of attorney often stops working the moment the person who made it can no longer make their own decisions. A durable power of attorney, however, is made to keep working through that kind of problem. It makes sure there is no gap in managing your money right when your family needs things to be stable.

This one feature can stop a lot of trouble. If you don’t have a DPOA, your family might have to go to court to ask a judge to give them the power to help you. This is called getting guardianship. That court process can be stressful and cost your family a lot of money in lawyer fees.

A Durable Power of Attorney isn’t about giving up control. It’s about taking control of what happens later by deciding now who will make choices for you if you can’t.

The Key Players in a DPOA

Understanding who does what is simple. This table shows the main parts of a Durable Power of Attorney.

Durable Power of Attorney at a Glance

| Part | Simple Explanation |

|---|---|

| Principal | This is you. You are the one making the paper and giving the power to someone else. |

| Agent | This is your trusted person. You choose them to act for you and manage your things. |

Basically, you are the principal who gives the power, and your agent is the trusted person who gets it.

Comparing Different Types of Power of Attorney

Choosing the right power of attorney is like picking the right tool for a job. You wouldn’t use a screwdriver to hit a nail. In the same way, you need the right kind of POA to protect your family. Understanding the differences makes sure your wishes are followed when it counts.

There are three main types: the General Power of Attorney, the Springing Power of Attorney, and the Durable Power of Attorney. Each one works differently, especially when someone gets sick.

The General Power of Attorney: Its Biggest Problem

A General Power of Attorney is a powerful paper. It gives your agent a lot of power to act for you as soon as you sign it. It’s like giving them the keys to your financial life—they can use your bank accounts, pay bills, and handle property right away.

But it has a big weakness. In Arkansas, if a general POA does not say it is “durable,” it stops working the moment you are unable to make your own decisions. This is its biggest problem. It fails at the exact time you and your family need it most.

Imagine you’re in a bad car accident and can’t talk. The general POA you made to pay your house payment is now useless. Your family would be stuck and would have to go to court for help.

The Springing Power of Attorney: A Tool with a Catch

A Springing Power of Attorney is different. It only starts working, or “springs” into effect, after something specific happens. You decide what that “something” is in the paper itself. Usually, it’s when one or two doctors write a letter saying you can no longer manage your own things.

This might sound like a good safety plan, but it often causes delays and problems. Getting doctors to sign legal papers during an emergency can be slow. While your family waits, bills can go unpaid and important dates can be missed. This adds more stress to a hard time.

The Durable Power of Attorney: Reliable and Ready

This brings us back to the Durable Power of Attorney (DPOA). As we said, its main strength is that it lasts. It can start working as soon as you sign it, just like a general POA, but it stays good even if you can’t make decisions anymore. This smooth continuation is what makes it the most important part of a good life plan here in Arkansas.

With a Durable Power of Attorney, there is no gap in power. Your chosen agent can step in right away to manage your things. This avoids the delays of a springing POA and the problem of a non-durable one ending.

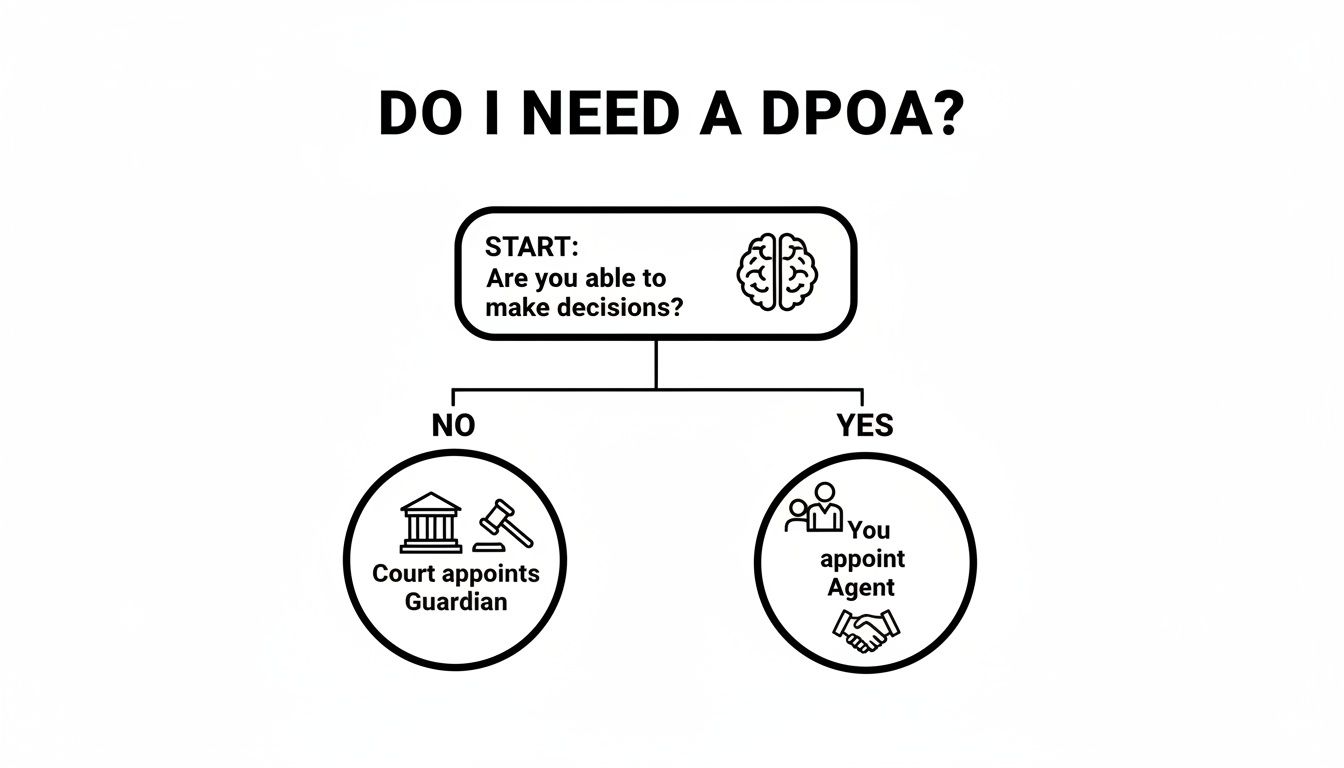

This chart shows the important choice you have: either you pick someone to make decisions, or a court will do it for you.

As the picture shows, planning ahead with a DPOA keeps you in control and helps you avoid a costly and public court case.

To really see how these papers compare, let’s look at them side-by-side.

Comparing Power of Attorney Types

This table shows exactly when each type of POA is working and if it keeps working during a health crisis.

| Type of POA | When It Starts Working | Stays Working If You Can’t Make Decisions? |

|---|---|---|

| General (Non-Durable) | Right after you sign it | No, it stops working. |

| Springing | Only after a specific thing happens | Yes, but only after it starts. |

| Durable | Right after you sign it | Yes, it keeps working. |

As you can see, for most people planning for the future, the Durable Power of Attorney gives the most dependable and ready protection. It makes sure your trusted agent has the legal power to act without waiting, giving you and your family real peace of mind.

How to Choose the Right Agent for Your DPOA

Picking the person who will be your agent is the most important choice you will make in this whole process. It’s about more than just picking someone you love. You are giving them the keys to your financial life. That means they need to be both trustworthy and capable.

This choice uses both your heart and your brain. You need someone you trust completely, but that trust needs to be paired with real-world skills. Think of it like picking an emergency contact who is also a trained medic—you need them to be caring and able to do the job.

Key Things to Look for in a Great Agent

So, what should you look for? The best agent is responsible, a good talker, and calm when things get stressful. Before you write a name on the paper, think about this checklist and see if the person you have in mind is a good fit.

- Completely Trustworthy: This is the most important thing. You cannot have any doubts about their honesty. Your agent will be able to see and control everything.

- Good with Money: Look at how they handle their own life. Are they organized? Do they pay their bills on time? They don’t need to be a money expert, just someone with good, everyday common sense about finances.

- Good at Communicating: Your agent might have to talk to banks, doctors, and even family members who may not understand. They need to be able to speak clearly and firmly, but also politely, to get things done.

- Willing to Do the Job: This is a big job to ask of someone. Being an agent can be stressful and take a lot of time. You must talk to the person you are thinking of and make sure they agree to take on this role.

Choosing the right person is a big step. For more help with this topic, you can look at our guide on selecting an agent for your durable power of attorney.

Deciding Your Agent’s Powers in Arkansas

Once you’ve picked your agent, you need to decide exactly what you want them to be able to do. Arkansas law lets you be very flexible. You can give your agent power over everything or limit them to only a few things. This paper should be made just for you and your life.

Think about the kinds of choices that would need to be made if you suddenly couldn’t make them yourself.

Your durable power of attorney should say clearly and exactly what powers you are giving. Unclear words are a problem—they can cause confusion and make banks or other places refuse to accept the paper right when your agent needs it.

Here are some of the most common powers people give their agents:

- Handle Banking: Using your checking and savings accounts to pay bills, put money in, and do other normal tasks.

- Handle Property: Buying, selling, or managing your house or land, which includes things like paying the mortgage and property taxes.

- Manage Investments: Making choices about your stocks, bonds, and retirement money to protect your savings.

- File Taxes: Getting your state and federal income tax papers ready and sending them in for you.

- Deal with Government Money: Applying for or managing money from Social Security, Medicare, or veterans’ programs.

This is just a starting list. You can give your agent the power to do almost anything you could do with your money. Or, you could make a limited power of attorney that only lets them do one thing, like sell one specific car. The key is to be very clear about what you want.

Always Name a Backup Agent

Life can be surprising. The person you pick as your main agent might not be able to do the job when the time comes. They could move far away, get sick themselves, or even pass away before you.

For this reason, it’s very important to name at least one successor agent—a backup. This makes sure that if your first choice can’t act, someone else you trust is already allowed by law to step in right away.

Without a backup, your family could end up right back where they started: in court for a stressful and expensive guardianship case. Naming a backup adds another layer of safety to your whole plan.

Making Your Arkansas DPOA a Legal Paper

You’ve decided to make a durable power of attorney—that’s a great step. But the paper itself is just paper until you make it official. A DPOA that isn’t signed correctly is useless. A bank could say no to it, or a court could throw it out right when your family needs it.

To turn your plan into a real legal tool, you have to follow the specific rules here in Arkansas.

Think of it like building a bridge. You can have the best plan in the world, but if you don’t use the right parts and follow the rules, the bridge will fall down. Your DPOA is that bridge, and the legal rules are what make it strong enough to rely on.

The Notary Public Rule

Here in Arkansas, the most important step to make your DPOA legal is to sign it in front of a notary public. This isn’t just a good idea—it’s the law.

A notary public is a person approved by the state to be an official witness. Their job is to check who you are, watch you sign, and make sure you are doing it because you want to, without anyone forcing you. When the notary adds their signature and official stamp, they are legally saying that everything was done correctly.

This simple step adds a strong layer of protection. It makes an official record that you were thinking clearly and signed the paper the right way. This makes it very hard for anyone to later say the signature was fake or that you were forced to sign.

Should You Add Witnesses?

Arkansas law says a DPOA must be notarized, but adding witnesses is a smart idea for extra safety. Even though it’s not required for this paper, having two adults watch you sign can make your DPOA even stronger.

Why do it? Witnesses add more proof that you signed the paper because you wanted to and knew what you were doing. Think of it like having extra security cameras in a bank vault—it just makes everything safer.

Here’s why we almost always suggest it:

- A Stronger Defense: If a family member ever tries to challenge the DPOA in court, your witnesses can tell the judge what happened when you signed it.

- Easier to Use: Banks and other companies are often more willing to accept a paper that has been both notarized and witnessed. It shows them you took the process seriously.

- Complete Peace of Mind: Knowing you’ve done everything possible to make your DPOA strong brings comfort to both you and the person you chose as your agent.

The Value of Professional Help

Getting these details right is very important. Many people need a good plan for the future, but so few have one. This is where a correctly made DPOA is so helpful.

Working with a lawyer makes sure that every Arkansas rule is followed, from the exact legal words in the paper to the final signatures. This gets rid of the risk of using a general online form that might not work when you need it.

Finally, while we focus on Arkansas rules, it’s good to know about how laws are changing. As legal papers become more digital, it’s helpful to understand them. Because laws are different everywhere, looking at state-specific electronic signature laws can give you a bigger picture of how your DPOA fits into today’s world.

Common DPOA Mistakes You Must Avoid

Making a durable power of attorney is a smart way to protect yourself and your family. But it’s also a place where small mistakes can cause big problems. A small error now can make your DPOA useless later on, causing family fights and legal troubles.

Think of your DPOA as a shield. But a poorly made one has holes in it. Let’s talk about the most common problems so you can make sure your shield is strong.

Choosing the Wrong Person as Your Agent

This is the most important choice you’ll make—and the easiest one to get wrong. It’s normal to want to pick the person you are closest to, like your spouse or oldest child. But love is not the only thing that matters. Your agent needs to be someone who is trustworthy, organized, and calm.

A quick story: Sarah named her brother, Tom, as her agent. He was charming and she loved him, but he had always been bad with money. When Sarah had a stroke, Tom thought he could “borrow” some money from her accounts for his own business. He was sure he would pay it back. He didn’t, and by the time another family member found out, Sarah’s savings were gone.

Before you write a name on the paper, ask yourself these questions:

- Is this person good with their own money?

- Are they organized and good with details?

- Can they stay calm and make hard choices when things are stressful?

Using Unclear Words for Powers

A DPOA is a legal paper. In the legal world, unclear words are the enemy. If your DPOA gives your agent “the power to handle my finances,” you are asking for trouble. Banks and other companies are careful. If they see words that are not specific, they will often refuse to accept the paper.

This leaves your agent stuck. They have the DPOA, but they can’t do anything. They can’t pay your bills or get money for your medical care. Being very clear from the start stops this from happening.

Instead of saying “handle my financial affairs,” a good DPOA will be specific. It will list powers like “to use and manage all bank accounts,” “to sell, rent, or mortgage property,” and “to prepare and file income tax forms.” This leaves no room for confusion.

Using General Online Forms

It’s easy to want to download a free DPOA form from the internet. Please don’t do this. These general forms can cause big problems. For one, they often don’t follow the specific legal rules here in Arkansas. A paper that works in Florida might not be legal here.

More importantly, a template can’t know about your life—your family, your things, or what you want. You are not general, and your legal protection shouldn’t be either.

Another real story: Mark used a free online form for his DPOA. After an accident, his agent tried to use it to manage his retirement money. The company said no because the form was missing specific words that their company required. This forced Mark’s family into a long and expensive court case. This is a common story. Sometimes, simple mistakes can cause huge delays—one report found that a similar paper in the UK took over 10 years to get approved. You can read about how mistakes cause these delays to understand why getting it right is so important.

Forgetting to Name a Backup Agent

Life can be surprising. What happens if your chosen agent gets sick, passes away, or just can’t do the job when the time comes? If you haven’t named a backup—also called a successor agent—your DPOA becomes useless.

This one mistake puts your family right back where you started: going to court to have a guardian picked for you. By simply naming one or two backup agents, you create a clear plan. It makes sure someone you trust is always ready to step in, keeping control of your life with your family, not a judge.

How a DPOA Protects Your Family and Your Future

Now that you know what a durable power of attorney is, let’s talk about the real reason people make them: peace of mind. A DPOA is more than a legal form. It’s a strong shield that protects you and your family from the stress, delay, and high cost of having a court pick a guardian for you.

Without this simple paper, if you could no longer make decisions, your family would be stuck. They would have to ask a judge just for the power to pay your bills or manage your medical care. This public court process, called a guardianship, can be very hard on a family’s emotions and money.

Avoiding the Guardianship Court Trap

What happens when an adult can no longer make decisions and doesn’t have a DPOA? They end up in a guardianship case. This is where a judge—not you, not your family—decides who will manage your life and your money. It’s a process that is often slow, very expensive, and feels like an invasion of privacy.

A DPOA helps you and your family avoid all of that. Here’s what you skip:

- High Legal Costs: A guardianship can easily cost thousands of dollars in lawyer fees and court bills, taking away the money you worked hard to save.

- Painful Delays: The court system is slow. While you wait for a judge, bills can pile up and important money choices are not made, adding a lot of stress.

- Loss of Privacy: Guardianship cases are public. This means your private money and health information becomes part of a file that anyone can see.

- Loss of Control: A judge, a stranger who doesn’t know you, makes the final choice. The person they pick might not be the one you would have chosen.

By making a durable power of attorney, you are taking control now. You make sure your future is managed by someone you know and trust. It’s a private way to handle a private matter, keeping your family out of a public courtroom.

Protect What Matters Most

This paper isn’t just for older people. It’s for any adult in Arkansas who wants to make sure their things are handled correctly if something unexpected happens. A sudden sickness or a bad car accident can happen at any age. A DPOA is your plan for when life is uncertain.

Your future is worth protecting. Taking the next step is simple. By talking with a lawyer, you can make a plan that fits your life, keeps your things safe, and protects the people you love from future problems.

At DeWitt & Daniels, our team is ready to help you build that protection. We’ll guide you through every step to make sure your durable power of attorney is a strong, dependable plan for your family and your future.

Frequently Asked Questions About DPOAs in Arkansas

When you plan for the future, a durable power of attorney can bring up some important questions. Let’s go over some of the most common ones we hear from people in Arkansas to help clear things up.

When Does a Durable Power of Attorney End?

A durable power of attorney is a strong tool, but it doesn’t last forever. Its power stops the moment the person who made it (the principal) passes away. After that, their will or trust takes over and says how their things should be handled.

It’s also important to know that the principal is always in charge. They can cancel or revoke the DPOA at any time, as long as they are still able to make their own decisions. In Arkansas, you can’t just say it’s canceled; you must write it down and give the paper to the agent for it to be official.

Can I Name More Than One Agent?

Yes, you can. It’s possible to name co-agents who can act together for you. But this can get tricky. You have to be very clear in the paper if they can make choices on their own or if they must always agree. If they must agree, it can cause delays if they can’t.

A much simpler and better way is to name one main agent and then one or two successor agents as backups. This creates a clear line of command. If your first choice can’t do the job, your backup is ready to step in without any delay or confusion.

What if a Bank Won’t Accept My DPOA?

This is a common and frustrating problem, but you have legal rights. Arkansas law does not let banks or other places turn down a valid DPOA for no good reason. A bank can’t just say “no” without a real, written reason.

If a bank or company turns down your correctly made Durable Power of Attorney, they could be responsible for paying for any problems or lawyer fees that happen because of it. A lawyer can help you make sure they accept the paper so your agent can manage your things like you wanted.

How Much Does a DPOA Cost?

The price for a lawyer to write a durable power of attorney can be different from place to place, but it’s a small price to pay for peace of mind. Think of it like a check-up for your financial and personal life.

The real cost is what happens when you don’t have one. If you become unable to make decisions, your family might have to go to court for a guardianship. That process can easily cost thousands of dollars in lawyer fees and take months, all while your private life becomes public. A good DPOA protects your family from that expensive and stressful situation.