When you’re getting a divorce in Arkansas, one of the first things to figure out is who gets what. This whole conversation starts with one simple idea: marital property.

Think of it like this: almost everything you and your spouse got after you got married is called marital property. It doesn’t matter whose money bought it or whose name is on it. If you got it while you were married, it’s usually considered shared.

What Property Division is All About

So, what does “marital property” really mean? It’s the legal term for all the stuff and even the debts that a couple gets during their marriage. This is the starting point for how courts in Arkansas decide how to split everything up when a couple divorces.

Imagine your marriage is like a team. Before the team started (your wedding day), you each had your own things. That’s your separate property. But from the moment you got married, everything you both earned, bought, or were given became part of the team’s stuff.

This pile of shared stuff is bigger than you might think. It’s a lot more than just the house and the car.

What Counts as Marital Property?

Marital property can be things you can touch and things you can’t. Of course, it includes the house, cars, furniture, and money in the bank. But it also covers things like retirement accounts (like a 401(k)), savings for retirement, and even a business that was started during the marriage.

Basically, if you got it between your wedding day and the day you separate, it’s probably going to be shared. You can get a better idea of what this includes from resources like the Corporate Finance Institute.

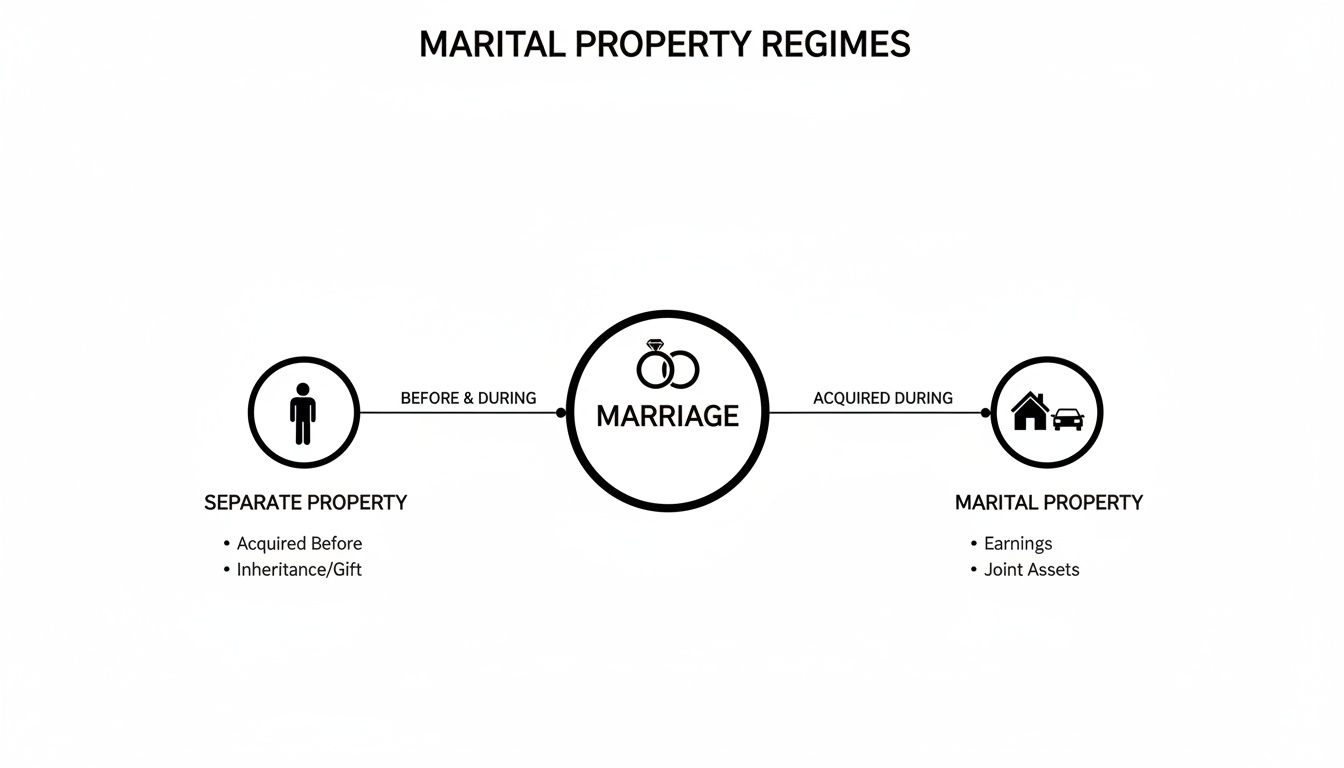

This picture helps show how it works.

As you can see, when you got something is very important. What you owned before is yours. What you got together is shared.

The “Starting Point” Rule in Arkansas

Arkansas law starts with a big assumption: any property you get from your wedding day on is probably marital property.

This is a big deal. It means the court automatically thinks that the new car, the savings account, or the new furniture belongs to the marriage, even if only one person’s name is on it. Why? Because the law sees marriage as a team effort. Both people help out, whether it’s by earning money, taking care of the house, or raising kids.

Marriage is treated like a team. The law sees value in the person who earns money and the person who takes care of the home. The things the team gets from that joint effort are considered shared property.

This starting point is very important. If you think something you got during the marriage should be your separate property, you have to prove it. You’ll have to show clear proof that it was a personal gift just for you or an inheritance that you kept totally separate from the shared family money. We’ll talk more about that later.

Marital Property vs. Separate Property: A Quick Look

It can be hard to keep these ideas straight. Here’s a simple chart to help you see the difference.

| Type of Thing | Usually Considered Marital Property If… | Usually Considered Separate Property If… |

|---|---|---|

| House | Bought or paid for with family money during the marriage. | Owned by one person before the marriage and family money wasn’t used on it. |

| Retirement Accounts | The part that was earned during the marriage. | The money that was in the account before the marriage. |

| Bank Accounts | Money from paychecks earned during the marriage was put in it. | An account owned before marriage that never had family money added to it. |

| Inheritance | Put into a shared bank account and used to pay family bills. | Kept in a separate bank account and never mixed with family money. |

| Money from an Injury Lawsuit | The part of the money for lost pay or medical bills the couple paid. | The part of the money that was just for the hurt person’s pain. |

| Gifts | A gift given from one spouse to the other during the marriage. | A gift from someone else (like a parent) that was clearly for only one spouse. |

This chart is just a general guide. What happens in your case will depend on the details, which is why getting help from an experienced lawyer is so important.

Understanding What Counts as Separate Property

We’ve talked about marital property—that shared shopping cart you and your spouse fill together during your marriage. But it’s just as important to understand the other type: separate property. This is the stuff that belongs to only one spouse, even after you’re married.

Think of it this way: separate property is what you brought with you into the marriage. It’s anything you owned completely before the wedding day. This could be a savings account you opened in high school, a car you bought when you were single, or even that old baseball card collection you’ve had forever. Because you owned it before the marriage started, Arkansas law usually says it’s yours alone.

Things You Got Before the Wedding

The easiest type of separate property to understand is anything you owned before you got married. It all comes down to timing. If you owned it the day before your wedding, it starts out as your separate property.

This includes a lot of things:

- A House or Land: A home or land you bought by yourself.

- Bank Accounts: Money in a checking or savings account that was only in your name.

- Cars or Boats: A vehicle that was titled only to you.

- Investments: Stocks or retirement money you had saved up before getting married.

The value of these things at the time of the marriage is what’s considered separate. For example, if you had $10,000 in a retirement account when you got married, that first $10,000 is your separate property.

Special Cases During the Marriage

Separate property isn’t just about things you had before the wedding. A few special types of property you get during the marriage can still be considered yours alone. These are important exceptions to the rule that everything you get while married is shared.

The most common ones in Arkansas are:

- Inheritances: If a relative passes away and leaves you money or property in their will, that inheritance is legally yours. It doesn’t automatically become shared property.

- Gifts: A gift given just to you from someone else is also separate. For example, if your parents give you $5,000 for your birthday and make it clear the money is for you and no one else, it stays your separate property.

- Money from a Lawsuit: The part of money from a personal injury lawsuit that is meant to pay you back for your pain and suffering is usually your separate property.

But there’s a catch, and it’s a big one. To stay separate, these things have to be kept completely separate. This is where it can get confusing.

The Danger of Mixing Your Property

If there’s one rule to remember about separate property, it’s this: if you mix it with marital property, it can become marital property. This is called commingling.

Think of it like this: your separate property is a cup of red juice. Your marital property is a cup of yellow juice. As long as you keep them in their own cups, they stay separate. But the moment you pour the red juice into the yellow juice cup, you have orange juice. A court in Arkansas will almost always say that orange juice is marital property.

This happens more easily than you might think. A common example is putting a $20,000 inheritance check into the joint bank account you share with your spouse. Once that money is used to pay the mortgage, buy food, and pay for other family bills, it becomes almost impossible to tell which money was which. You’ve made “orange juice.”

It works the other way, too. Let’s say you use money from your paycheck (marital money) to make payments on a car you owned before the marriage. In that case, part of the car’s value may become marital property because you mixed marital money with your separate car. The only sure way to protect separate property is to keep good records and have separate bank accounts.

How Arkansas Courts Divide Property Fairly

When a marriage ends, one of the biggest questions is, “Who gets what?” In Arkansas, the answer isn’t as simple as cutting everything in half. The state doesn’t require a strict 50/50 split. Instead, it uses a rule called equitable distribution.

That legal term just means the division of marital property has to be fair, which isn’t always the same as equal.

Think of a judge less like a person with a saw and more like a person with a balancing scale. They don’t just chop all the property in half. They carefully weigh different things on each side of the scale to find a truly fair balance for both people. This way recognizes that every marriage is different, and a one-size-fits-all split is often unfair.

The Factors That Tip the Scales

So, what does a judge put on this scale to figure out what’s fair? Arkansas law gives them a list of things to look at. These things help the court see the whole picture of the marriage—not just the amount of money in bank accounts.

A judge will look at things like:

- How Long the Marriage Lasted: A 25-year marriage is seen very differently than a two-year marriage.

- Age and Health: The court thinks about the physical and emotional health of each person.

- Job and Income: A judge looks at what each person does for a living and how much money they can earn in the future.

- Job Skills and Ability to Get a Job: This looks at how well a person can support themselves after the divorce.

- Contributions to the Marriage: This includes the important, non-money work of a person who stayed home to take care of the house or kids.

That last point is very important. The law puts just as much value on the work of a parent who stayed home to raise the kids as it does on the spouse who earned the main paycheck. This makes sure that a stay-at-home parent’s years of hard work are counted when it’s time to split the marital property.

Starting with a 50/50 Idea

While the main goal is to be fair, Arkansas law does start with a general idea: an equal split is usually fair. The court starts by thinking about a 50/50 split and then changes it based on the factors we just talked about.

If a judge decides that an unequal split is fairer, they have to explain why in the final divorce papers. For example, if one spouse can earn a lot more money and the other is in poor health, the judge might give a larger share of the property to the spouse who needs it more.

In a state like Arkansas, the court’s main job is to get a fair and just result. The law allows them to change the property split to match the real-life situation of the family.

This system is common across the country. While 41 states use some form of this “fair split” rule, they all recognize the team effort involved in a marriage. It’s interesting that studies often show having shared property can help a marriage last. Owning a home together—which 65% of married couples in the U.S. do—is a sign of a shared future.

Why Knowing the Value of Property Is Important

You can’t split property fairly if you don’t know what it’s worth. Figuring out the true value of every item, especially a house, is a very important first step. Learning about ways for finding real estate comps can be a helpful in this process.

This makes sure that when a house, business, or another big item is divided, the value is based on real numbers, not just a guess. Without correct values, a split that looks fair can end up being very unfair.

Common Things and Potential Problems

When you start to separate your money in a divorce, some things are pretty clear. The house you bought together, the shared bank account, the family car—these are usually easy examples of marital property. But where things get tricky, and where fights often happen, is with the more complicated stuff.

It’s not just about what you own; it’s also about what you owe and how some things grew or changed over the years. Knowing where the potential problems are can make the whole process a lot easier.

Simple Marital Property

Let’s start with the easy stuff. In almost every Arkansas divorce, these things are seen as marital property and will be split between both people:

- The Family Home: If you bought your house while married, it’s marital property. It doesn’t matter whose name is on the house papers.

- Shared Bank Accounts: Any checking or savings accounts you put money into from paychecks earned during the marriage are shared.

- Cars and Trucks: Vehicles bought with family money fall into this group.

- Retirement Accounts: This is a big one. The part of a 401(k) or retirement plan that grew between your wedding day and the day you separated is marital property.

These things are the basic parts of the “marital estate.” The real headaches, however, usually come from things that aren’t so easy to define.

Common Problems in Splitting Property

This is where things can get hard. Some things have a way of blurring the lines between what’s “yours” and what’s “ours,” and they often become the biggest source of fights in a divorce.

One of the hardest issues is a business owned by one spouse. Even if the business was started before the wedding, any increase in its value during the marriage could be seen as marital property. This is especially true if the other spouse helped out, either by working at the business or by taking care of the home, which let the business-owning spouse focus on making it grow. Figuring out business ownership during a divorce takes a smart lawyer.

In Arkansas, the court believes that both spouses help the marriage succeed—and also help its property grow. A business that did well during the marriage is often seen as a product of that team effort.

Another major problem area? Debt. Just like property, any debts you got while married are also considered marital property. This includes credit card debt, home loans, and car loans. A judge will split these debts fairly between you, even if one person did all the spending.

To help make it clearer, here’s a list of common things and how they are usually sorted.

How Common Things Are Sorted in an Arkansas Divorce

| Item | How It’s Usually Sorted | Why It’s Important |

|---|---|---|

| Family Home (Bought During Marriage) | Marital Property | This is often the biggest thing a couple owns. Its value is split, no matter whose name is on the papers. |

| Inheritance or Gift (to one spouse) | Separate Property | As long as it was kept separate (not put in a shared bank account), it belongs only to the person who got it. |

| 401(k) or Retirement Plan | Mixed (Part Marital, Part Separate) | Only the value that was added from the wedding day to the separation day is marital property that gets split. |

| Business Owned Before Marriage | Mixed (Part Marital, Part Separate) | The increase in the business’s value during the marriage is often seen as marital and will be split. |

| Credit Card Debt (in one name) | Marital Property | If the card was used for family things (like food or trips), the debt belongs to the marriage and will be split. |

| Money from an Injury Lawsuit | Depends on what the money was for | Money for lost pay is marital. Money for pain and suffering is often the separate property of the hurt person. |

Understanding these differences is the first step toward a fair agreement. It’s what lets you protect what’s yours while making sure the marital property is split correctly.

How Are Gifts and Debts Handled?

What about gifts between spouses? This can be confusing. If one spouse gives the other an expensive gift during the marriage—like jewelry or a car—it’s almost always considered marital property. The court thinks it was bought with marital money and, therefore, belongs to the marriage.

Splitting debt is just as important. Even if a credit card is only in one person’s name, if it was used for family things like food, vacations, or home repairs, the debt is likely marital. The court will split it fairly, often looking at who is in a better financial spot to pay it off.

Having money is a big part of a stable marriage. Interestingly, research shows that while every state tries to be fair, the results can be different. In states like ours that use a “fair split,” women often get 40-45% of marital property, while they get closer to 50% in other states. This money issue might be one reason divorce rates are 40% lower for couples with more money—when big things like retirement accounts are at risk, there’s a strong reason to work things out. You can learn more about these property rights findings and how they are seen around the world.

Practical Steps to Protect Your Financial Future

Thinking about your money before or during your marriage isn’t about expecting bad things to happen—it’s about smart planning. It’s about making a clear plan so everyone is on the same page from the start. Taking a few smart steps can protect your things and save you from big headaches later. Being prepared is just smart, not a sign that you don’t trust your partner.

These steps are really about making things clear in your relationship. When you both understand what’s separate and what’s shared, you get rid of a lot of worry about money. Being open like that can actually make your team stronger.

Using Marital Agreements Wisely

One of the best tools you have is a marital agreement. And let’s be clear: these aren’t just for super-rich people. They are smart, useful tools for any couple wanting to decide their own financial future.

There are two main types you should know about:

- Prenuptial Agreements: This is a paper you and your partner sign before you get married. It’s your chance to write down exactly how your things and debts will be handled if the marriage ends.

- Postnuptial Agreements: This is basically the same idea, but it’s a paper you sign after you’re already married. Many couples do this if something big changes with their money, like one person starting a business or getting a lot of money from an inheritance.

Think of these agreements as a personal rulebook for your money. Instead of letting the state’s laws decide what’s marital property, you and your spouse make those decisions together. This can prevent a huge amount of stress and fighting later on.

A marital agreement is like a financial plan for your marriage. It makes sure both of you have a clear, shared understanding of your financial rights from the very beginning.

By talking openly about money and putting your decisions in writing, you’re building a strong and honest financial base for your whole marriage.

How to Keep Separate Property Safe

Even if you don’t have a formal agreement, there are simple things you can do every day to keep your separate property from getting mixed up with marital property—a process we call commingling. It all comes down to keeping clear lines between what’s yours, what’s theirs, and what’s ours.

Here’s a simple checklist to help you avoid the most common mistakes:

- Do Keep Separate Bank Accounts: If you get an inheritance or a big cash gift, put it into a bank account that is only in your name. Don’t ever put it into a shared account with your spouse.

- Don’t Use Separate Money for Marital Bills: Try not to use money from your separate account to pay for shared bills like the mortgage, food, or a family vacation. Once you start mixing money, it can easily be seen as marital property.

- Do Keep Good Records: Keep every paper that proves something is yours alone. This means saving bank statements from before the marriage, house papers, car titles, and copies of any wills or gift letters.

- Don’t Add Your Spouse’s Name to Separate Property: If you owned a house before you got married, be very careful about adding your spouse’s name to the official papers. The moment you do that, you’ve likely turned your separate property into marital property.

Following these simple habits helps build a wall around your separate things. It makes it much easier to tell what’s what if you ever need to.

Common Questions About Splitting Property in Arkansas

When you’re going through a divorce, the legal words can sound like a different language. It helps to get straight answers to the questions that people ask most often. Let’s look at some of the common worries we hear every day from our clients here in Northwest Arkansas.

What Happens to the Family Home in a Divorce?

For most couples, the house is more than just their biggest financial asset—it’s home. That emotional connection makes it a big point of disagreement. In Arkansas, you usually have three options:

- One spouse buys the other’s share. If you want to stay in the home, you can pay your spouse for their part of the home’s value. This almost always means you’ll need to get a new home loan in your name only to pay them.

- You sell the house and split the profit. This is often the cleanest way. You sell the home, pay off the loan, and then split the money that’s left.

- You wait to sell. Sometimes, especially when there are young kids, a judge might let one parent stay in the home for a certain amount of time. After that time is up, the house is sold, and the money is split.

There’s no single “right” answer here. The best choice really depends on your money and what makes the most sense for your family’s future.

Is My 401(k) Considered Marital Property?

Yes, absolutely. The part of your 401(k) or other retirement account that you earned during your marriage is considered marital property. This surprises a lot of people, especially since the account is only in one person’s name.

Think of it this way: the law sees your marriage as a money team. Any money you built together during that time—including retirement savings—is a result of your team effort, no matter whose paycheck it came from.

Because that money is part of the marital property, it has to be split fairly. But you can’t just write a check to split a 401(k). It needs a special court order called a Qualified Domestic Relations Order (QDRO). This is a very important legal paper that tells the retirement plan company how to split the account without causing tax problems.

What if My Spouse Racked Up a Lot of Debt?

In Arkansas, debts are handled a lot like property. If a debt was created during the marriage, it’s almost always considered marital debt. That means credit card debt, car loans, and personal loans are usually split.

This is true even if the debt is only in one spouse’s name. If the money was used for the good of the marriage—like for food, family trips, or home repairs—it’s a shared debt. A judge will split these debts fairly, often looking at who is in a better position to pay them back. However, if one spouse secretly ran up huge bills for things that didn’t help the family, a judge has the power to make that debt belong only to the person who created it.

Need Help with Your Property Division Case?

Figuring out what is marital property is just the first step. The path through an Arkansas divorce is often stressful and confusing, but you don’t have to do it alone. Having an experienced local lawyer on your side can be the most important thing you do to protect your financial future.

A good lawyer does more than just fill out papers. They become your guide and your fighter, making sure your rights are protected from start to finish. They’ll help you understand the legal words and work toward a result that’s truly fair.

Your Advocate in Northwest Arkansas

Here at DeWitt & Daniels, we aren’t just lawyers who work in Northwest Arkansas—this is our home. We have a deep, real-world understanding of the local courts in Fayetteville, Bentonville, Rogers, and Springdale. We know that splitting up a lifetime of property isn’t just a legal matter; it’s deeply personal and emotional.

Our way of doing things is simple: we mix compassion with a smart, planned approach to make sure your voice is heard. Our goal is to help you start your next chapter with confidence and financial security.

We promise to give you clear, honest advice. Our team will work hard to find every piece of marital property, make sure everything is valued correctly, and build a strong case for a property split that truly shows your contributions to the marriage.

Nothing is more important to us than your financial health. The decisions made during your divorce will affect you for years, and we are here to make sure they are the right ones for you.

If you’re facing a divorce and have questions about how your property will be split, let’s talk. Schedule a consultation with DeWitt & Daniels today to go over the details of your situation. We’re ready to help you get a fair result and secure your future.