Have you ever heard the old saying, “Look before you leap”? That’s really all due diligence is. It’s like doing your homework before making a big choice, like buying a business, a house, or even just agreeing to a serious deal.

Imagine you’re checking out all the details to make sure there are no bad surprises waiting for you. In Arkansas, this process means looking into things according to state laws to protect yourself and your money. It’s a careful investigation to make sure what you see is what you get.

Why Due Diligence Is Your Business’s Best Friend

Let’s use a simple example. Imagine you want to buy a popular barbecue spot in Little Rock. It’s always busy and seems to be making a lot of money. Would you just hand over all your savings without checking things out first? Probably not.

You’d want to look behind the scenes. You would check the financial books to make sure the money is real. You would look at the rental agreement for the building and check the deals with food suppliers. This whole process of checking things before you buy is exactly what due diligence is all about.

The Real Goal: Getting to the Truth

At its heart, due diligence is about making sure facts are true. You’re checking that the business or property is really what the seller says it is. For anyone in business in Arkansas, this is a safety step you can’t skip.

Basically, you get to be a detective for your own deal. Your job is to find answers to important questions:

- Are the money reports correct?

- Are there any hidden debts or legal problems?

- What’s the real story with the workers, the contracts, or the company’s brand?

- Is the price fair for what the business is really worth?

Answering these questions helps you avoid paying too much or, worse, buying a business with big problems. This isn’t just for buying a company. You’d do due diligence when buying property, checking out a new business partner, or even making plans for your own money and property. A similar level of care is essential when you learn more by exploring the fundamentals of what is estate planning.

To put it simply, a good due diligence check has a few main goals.

Key Goals of a Due Diligence Check

| Goal | Why It Matters for Your Business |

|---|---|

| Verify Information | Makes sure the seller’s claims about money, property, and how the business runs are true. |

| Identify Risks | Finds hidden problems like debts, legal troubles, or weak spots in the business. |

| Confirm Value | Helps you decide if the price is fair based on what you find out. |

| Gain Confidence | Gives you the facts you need to go ahead with the deal, ask for a better price, or walk away. |

This table sums it up: the process is all about getting the whole story so you can make a smart choice instead of a risky guess.

It’s Not Just a Good Idea—It’s often Required

In many business deals in Arkansas, especially big ones, doing your homework isn’t just smart—it can be required by law. It shows you acted responsibly. For example, under the Arkansas Business Corporation Act, company directors must act with the care that a “prudent person” would use. This includes doing due diligence before making major decisions for the company.

In the end, this process gives you power. It gives you the proof you need to move forward, the strength to ask for a better deal, or a clear sign to walk away if you find too many problems. Understanding and doing due diligence is one of the best ways a business owner can protect their future.

Why Due Diligence Is a Non-Negotiable Step

So, why do smart businesses spend so much time and effort on due diligence? Think of it this way: skipping it is like buying a house without an inspection. You might get lucky, or you might find out later it has a bad foundation and a leaky roof. This investigation is your protection against a bad deal.

For any Arkansas business, this means avoiding deals that could lead to money trouble, finding hidden legal problems, and making sure you’re paying a fair price. It’s the best tool you have for managing risk before you sign any papers.

Protecting Your Investment and Your Future

The main point of due diligence is to manage risk. Every big business deal, whether you’re buying another company or a building, has possible risks. The seller will always show you the good parts, but your job is to find out what’s really going on.

Due diligence is your chance to get the full story. It’s meant to find problems before they become your problems. This could be anything from hidden debts and legal fights to old equipment or unhappy customers.

“A failure to exercise due diligence may sometimes result in liability.” – Black’s Law Dictionary

This quote makes a very important point. Not doing your homework isn’t just a bad business choice; it can get you into serious legal and money trouble. People expect you to take reasonable steps to check things out before you agree to a deal.

Building Trust and Ensuring a Fair Deal

A good investigation also helps build trust between the buyer and seller. When a buyer asks detailed questions and the seller answers honestly, it helps create a good relationship. This open talking can make the whole deal go more smoothly.

It also makes sure you’re paying a fair price. Without looking deep into the money, operations, and how the business compares to others, how can you know if the price is right? For a buyer, due diligence is the only way to truly understand what a company is worth. This careful evaluation is critical to learning how a buyer will assess your company.

This isn’t just a local trend. Due diligence has become a massive global industry, valued at an estimated $15.2 billion in 2023 and expected to nearly double to $28.9 billion by 2032. That growth shows just how seriously modern businesses take risk assessment.

A Legal and Strategic Must-Do in Arkansas

In Arkansas, due diligence is often a legal duty, not just a good idea. For people who run a company, like directors, doing proper due diligence is part of their job to protect the company and the people who own it (shareholders). This is called their “fiduciary duty.”

If they don’t do it, they could be seen as careless. Imagine buying a factory in Arkansas without checking its environmental records. If you later find out the land is polluted, the cleanup costs and legal fines could be huge—and they would be your problem as the new owner.

In the end, proper due diligence gives you the confidence to make a final choice. Knowing you’ve checked everything allows you to act on facts, not just feelings. It protects your company, your workers, and your future.

Breaking Down the Types of Due Diligence

Due diligence isn’t just one big task. It’s more like a team of people getting a car ready for a big race. One person checks the engine, another checks the tires, and a third checks the electronics. Each has a special job, but they all work together to make sure the car is safe and ready to go.

In the business world, these different jobs are different types of due diligence. Each type looks closely at a specific part of a company to make sure there are no bad surprises. By breaking it down, you get a full view of what you’re really buying.

Financial Due Diligence

This is usually the first and most important step. It’s like hiring a money detective—usually an accountant—to check if the company’s financial story is true. Their job is to make sure the numbers the seller shows you are real.

They look for answers to some basic questions:

- Are the profits and sales numbers real and reported correctly?

- Are there hidden debts or surprise costs that aren’t on the main money reports?

- Does the company have enough cash flow to pay its bills?

This deep look into the numbers checks the company’s financial health. It’s how you avoid buying a business that looks good on paper but is actually in debt.

Legal Due Diligence

Next, you bring in your legal expert. Your lawyer’s job is to check the business for any legal problems, making sure it follows the rules and isn’t in any legal trouble. This is very important in Arkansas, where state laws affect contracts, property, and how businesses run.

A failure to exercise due diligence may sometimes result in liability. This means that if you don’t do your homework and later find a legal problem, it could become your responsibility.

A good legal check will look for warning signs like:

- Lawsuits: Are there any current or possible lawsuits against the business?

- Contracts: Are the agreements with workers, suppliers, and customers legal and solid?

- Compliance: Is the company following all Arkansas and federal rules, like environmental or safety laws? This is especially important for certain industries like healthcare or banking, which have many specific state regulations.

This step protects you from taking on someone else’s legal problems, which can be very expensive and stressful to fix.

Commercial Due Diligence

Checking the money and legal stuff is key, but you also need to know if the business itself is a good idea. That’s what commercial due diligence is for. It’s about looking at the business from a bigger view—how it works and where it fits in the market.

This check answers big-picture questions. It looks at the company’s place in the market, its customers, and its competitors to make sure it can succeed in the long run. You’ll get clear answers to questions like, “Do people really want what this company sells?” and “Can it compete and grow in the future?”

Human Resources Due Diligence

A company is really its people. Human resources (HR) due diligence focuses on the team, from the managers to the newest workers. An HR expert will look at employee contracts, pay, company culture, and any past problems with employees. An essential part of this, aimed at building a trustworthy team, involves thorough employee background checks.

This check gives you an idea of how strong the team is that you might be taking over. It can find hidden problems like a lot of people quitting or employee complaints that could cause trouble after you buy the business. By looking at all these different parts, you can finally make a smart decision.

Your Practical Due Diligence Checklist

Knowing you need to do your homework is one thing, but where do you start? It can feel like a lot. Let’s break it down into a simple plan. Think of this as a step-by-step guide to get you from beginning to end.

This checklist turns a big job into a clear plan, giving any Arkansas business owner the confidence to move forward.

Step 1: Assemble Your Team of Experts

You wouldn’t do your own surgery, right? The same idea applies here. Your first step should be to build a team of professionals. These experts are your guides, trained to see problems you might miss.

Your team should usually include:

- A Lawyer: They’ll handle all the legal checks—looking at contracts, checking for lawsuits, and making sure everything follows Arkansas state laws. Their job is to keep you from getting into legal trouble.

- An Accountant: This is your money detective. They’ll go through the financial records, check the numbers, find hidden debts, and show you the true financial health of the company.

- Industry Specialists: Depending on the business, you might need someone with special knowledge. Buying a software company? An IT expert is a must. Looking at a farm? An agricultural expert can help.

This team is your investigation crew. They know where problems often hide.

Step 2: Create Your Information Request List

With your team ready, it’s time to make your “shopping list” for information. This is called a due diligence checklist. It’s a detailed list of every document and piece of information you need from the seller to start your investigation.

To help you with this critical step, you can use an effective due diligence checklist template as a starting point. A good list is always organized by topic—like financial, legal, and operations—and asks for specific things such as:

- Financial reports for the past three to five years.

- Copies of all employee contracts and benefit plans.

- A list of all physical things the company owns, like equipment or buildings.

- Details of any past or current legal cases.

- Copies of important contracts with customers and suppliers.

This list gives your investigation a clear plan and makes sure you don’t forget anything important.

Step 3: Review Materials and Analyze Findings

Now for the real detective work. Once the seller gives you the documents, your team starts looking at everything very carefully. Each expert focuses on their area: the accountant checks the numbers, the lawyer looks at the contracts, and so on.

The goal here isn’t just to read papers; it’s to find warning signs or anything that seems wrong. You’re looking for differences between what the seller said and what the documents show.

A key part of this process is organizing findings by risk level—low, moderate, and high. You need to assess both the likelihood and potential impact of each risk. This helps you focus on what truly matters.

This is where you see the real benefit of due diligence. It’s how you go from just collecting papers to understanding what it all means for your deal.

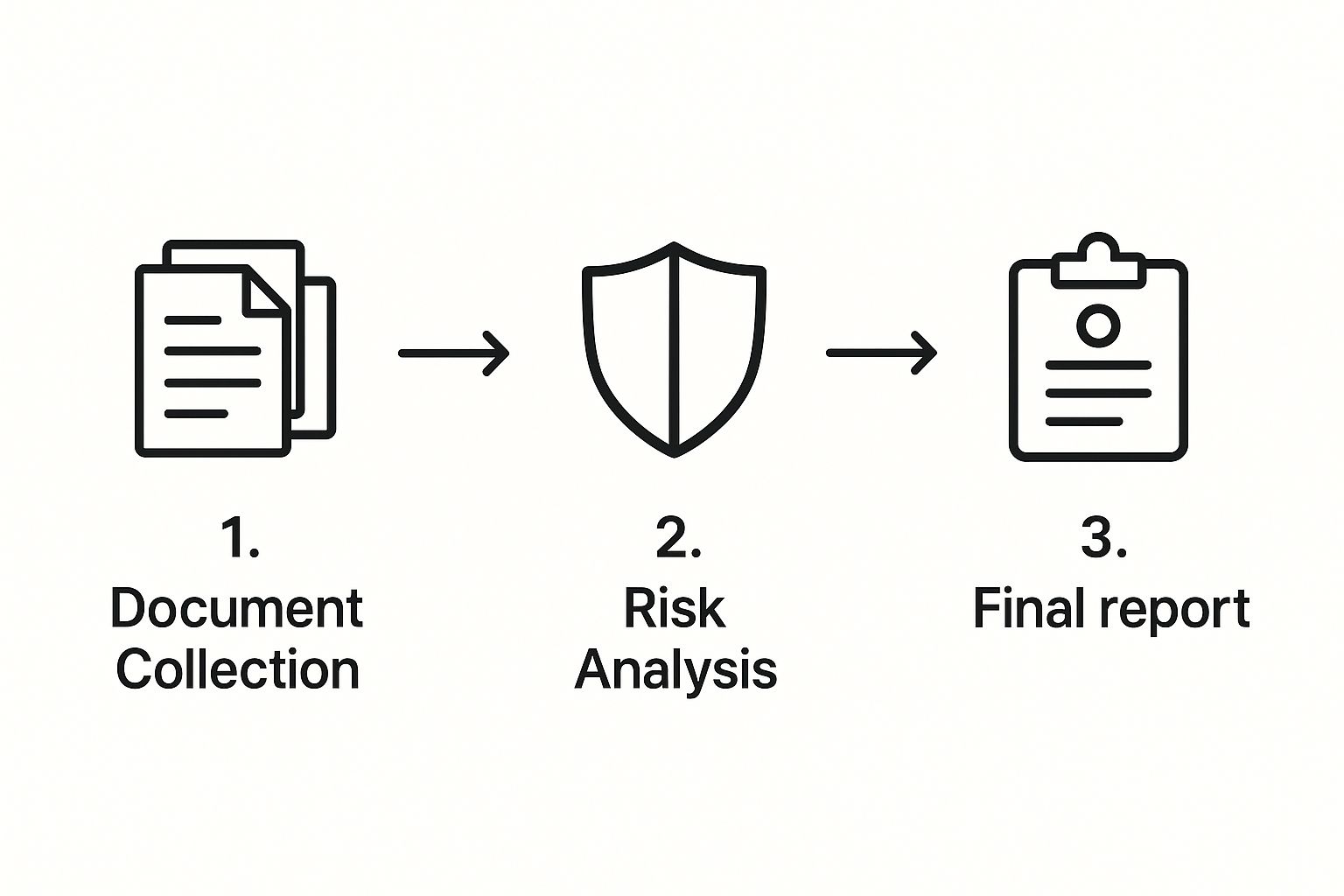

This infographic simplifies the core workflow, from gathering your documents to making a final call.

As you can see, the process moves from collecting information to checking it, all leading to a final report that helps you make a good decision.

Step 4: Prepare Your Final Report

After all the documents have been checked and key people have been talked to, your team will put everything into a final due diligence report. This is a summary of everything you’ve learned—the good, the bad, and the ugly.

This report will:

- Summarize Key Findings: It puts the most important things you found right at the top.

- Identify All Risks: It clearly lists any money, legal, or business risks you’ve found.

- Provide Recommendations: Based on what they found, your team will suggest what to do next.

That suggestion might be to go ahead with the deal, ask for a lower price because of the risks, or—in some cases—to walk away completely. This report is your guide to making a final, smart decision that protects your money and your future.

Real-World Lessons: Due Diligence Success and Failure

Learning the idea is one thing, but seeing how due diligence works in the real world makes the lesson stick. The best way to understand its importance is to look at real stories of success and failure right here in Arkansas. These stories show what can happen when you do your homework—and the high price you pay when you don’t.

Let’s look at a couple of examples that show the real rewards of being careful and the serious risks of cutting corners.

The Success Story: Dodging a Hidden Tax Bullet

Imagine a successful shipping company in Little Rock wants to grow. They find a smaller, local competitor that seems perfect to buy. The smaller company has good customers, a great name, and its money reports show a steady profit. On paper, it looked like a great deal.

But the buyer’s team of lawyers and accountants knew not to just trust the paperwork. During their legal and money check, they started digging. They didn’t just accept the seller’s nice-looking reports; they went straight to the government and asked for years of detailed tax records.

What they found was a ticking time bomb: a huge, unpaid tax bill. The company they wanted to buy had been misclassifying its workers for years, creating a big debt that was hidden from the main financial reports.

This one discovery changed the whole deal. If the buyer had skipped that deep check, they would have had to pay that debt as soon as they bought the company. This would have turned a smart purchase into a money disaster. Because they were so careful, they were able to walk away and save their company from a huge mistake.

The Failure Story: A Zoning Nightmare in NWA

Now for a story about what not to do. A business owner in Northwest Arkansas was excited to find what she thought was the perfect spot for her new brewery. The location was great, with lots of people walking by, and the price seemed very low. Excited to start her dream, she bought the property quickly.

She did a basic property inspection, which didn’t find any problems. What she didn’t do was proper real estate due diligence, especially checking the local zoning laws. She just thought that because the property was in a commercial area, her brewery would be allowed.

- She bought the property and spent thousands of dollars fixing it up.

- When she applied for her business permits, she was told no.

- She then learned the awful truth: the property was only for retail stores, not for making or serving alcohol.

This mistake was a disaster. She was stuck with a property she couldn’t legally use for her business, all because she skipped one important step. This kind of research is just as important as checking the foundation of a building. It’s a detailed investigation that shares similarities with processes in other legal fields, as our guide on what is probate explains.

As business deals get more complex, the need for this kind of thorough investigation has never been greater. The due diligence market itself is growing at a remarkable pace, expected to climb from a $7.57 billion valuation in 2024 to $10.97 billion by 2029. This boom is fueled by stricter regulations and the absolute necessity of managing risk across sectors like real estate, banking, and tech. You can learn more about these due diligence market trends to understand why this skill is more critical than ever.

Common Questions About Due Diligence

Even with a good plan, it’s normal to have some questions about what due diligence is really like. Let’s go over a few of the most common questions we hear from Arkansas business owners to help clear things up.

Getting these questions answered will help you feel more ready to start the process.

How Long Does Due Diligence Usually Take?

There’s no single answer. How long it takes really depends on how big and complicated the deal is. For a simple purchase of a small local store, you might get it all done in 30 to 60 days.

But for a bigger deal with many locations or tricky legal issues, the process can easily take 90 days or more. The most important thing is not to rush. Take the time you need to do a complete job.

Is Due Diligence Expensive?

Yes, it will cost some money, mostly to hire your team of experts like lawyers and accountants. You’re paying for their time and knowledge, which is an investment in protecting yourself.

But here’s the thing to remember: the cost of skipping due diligence is almost always much, much higher. Finding just one hidden legal problem or a lot of hidden debt can save you from a money disaster that would have cost far more than the investigation itself.

Think of it like an insurance policy. You pay a small amount now to avoid a huge problem later.

Can I Do Due Diligence Myself?

While you should definitely be very involved—getting documents, asking questions, and understanding the business—trying to do it all by yourself is a big risk. You can check basic records, for sure.

However, you really need a professional for the technical parts. Business and real estate deals in Arkansas are controlled by specific state laws, and a good lawyer makes sure you’re following them. Also, an accountant is trained to see money problems that most people would miss. It truly takes a team.

What Is the Most Important Part of Due Diligence?

While every part is important to get the full story, if you had to pick the most important, it would be the financial and legal checks. These are the two main pillars of a good deal.

The financial check tells you if the business is really making money. Is the business as healthy as the seller claims? The legal check is all about finding problems—like issues with regulations or bad contracts—that could become your problem after you buy. Getting these two areas right is absolutely critical.